Get Started With

servzone

Overview

Private limited company is a privately maintained small business, one of the highly recommended means to start a business in India. The Companies Act 2013 governs private limited company registration in India.

Whereas, a minimum of 2 shareholders is required to start a private company, whereas the Companies Act, 2013 has a higher ceiling of 200 members. If a private limited company faces financial risk, its shareholders are not subjected to selling their personal assets, that is, they need limited liability.

For online company registration, there should be a minimum of 2 directors, while a maximum of 15 directors can be appointed in a company. The proposed director should be 18 years of age. A foreign national can also become a director of a private limited company in India.

No minimum paid-up capital is required for private limited company registration. Every private limited company should use pvt.ltd.a after their name.

A private limited company has a never ending existence. A private limited company also exists in case of death or bankruptcy of its members.

A private limited company has no connection with the public; They are not allowed to ask for any collateral from the public or public areas. In a private limited company, people are not entitled to transfer shares, which protect the acquisition of private limited companies from large enterprises.

Some benefits;

- Perform international

Private limited companies support foreign direct investment, which requires licensing / licensing and approval from the administration, suitable for foreign investment to other types of firms.

- Ever exist

A private limited company has a lifelong existence. Private limited companies are treated as separate legal entities and are separate from the existence of their owners, which means they cannot be dissolved or terminated due to death, retirement or insanity of any of their member / director / shareholder. Can.

- Increased market price

A registered private limited company is considered more trustworthy than non-registered ones. Information about registration of private limited company can be easily obtained from the website of Ministry of Corporate Affairs. Sellers, suppliers and investors rely on other business structures. As a result, it increases the brand value of the company among customers and other investors and suppliers.

- Ease of transfer of ownership

It is quite easy to transfer equity to new members and issue new shares in a private company.

Basic requirements of online private limited company registration.

Some requirements For starting a private limited company

- The private limited company must have a specific name which should not be the same as any other registered company and trademark.

- It is mandatory for a private limited company to have at least two directors.

- It is also necessary to note that there should be a minimum of two shareholders in a private limited company.

- All directors of a private limited company must have a digital signature certificate which will be used to register the private limited company.

- No minimum capital is required to start a private limited company.

- The process of online company registration is quite simple; Make sure you have a specific name for your company which will definitely help you in quick company registration.

- You should avoid any offensive names for your private limited company registration.

Required Documents

- Articles of association

- memorandum of Association

- Declaration by customers and by directors

- A confirmation for the address of the office

- Copy of two months utility bill

- Certificate of inclusion of foreign country body corporate [if applicable]

- A resolution passed by the global company [if applicable]

- A recommendation declared by the promotional company [if applicable]

- Interest of directors of other entities [if applicable]

- Nominee and Ascent

- Identity proof and residential address of customers and nominees

- Identity proof and residential address of applicants

- Declaration / Resolution of unregistered companies

- Any other document [if required]

For Edge-Pro:

- Proof of principal place of business

- Evidence of appointment of authorized signatory for GSTIN

- Copy of any kind of authorization / resolution of documents passed by BOD

- Management committee and acceptance letter

- Proof of identity of the authorized signatory for opening a bank account

- Proof of address of the authorized signatory for opening a bank account

- Specimen Signature of Authorized Signatory for EPFO

Declaration

The declaration of the form 'INC-9' of subscribers and directors is essentially auto-generated in PDF format and submitted electronically. The aspirant is required to provide a recommendation with a certificate suggested by a professional, such as a company secretary, chartered accountant and cost accountant. However, if the total number of directors or clients is more than 20 or not entitled to the above mentioned liability.

Documents that can be used as proof of address

Documents that can be used as residential proof

Benefits

Some advantages.

- A registered private limited company increases the credibility of your business.

- Help owners with personal liability and protect against other risks and losses.

- Makes more customers

- Ease of obtaining bank credit

- Provides limited liability for the protection of its company and assets

- Greater Fund Supplement and More Attractive Sustainability

- Increase capacity to grow and expand

List of assistance

- Reservation of name (closed run for company registration)

- Director Identification Number (DIN) Allocation

- Company incorporation

- Issue of PAN for the company

- Issuing tan

- Registration of company as an employer with EPFO

- ESIC registration for the company

- Profession tax registration for the state of Maharashtra

- Bank account opening.

- Company registration as taxpayer in GST

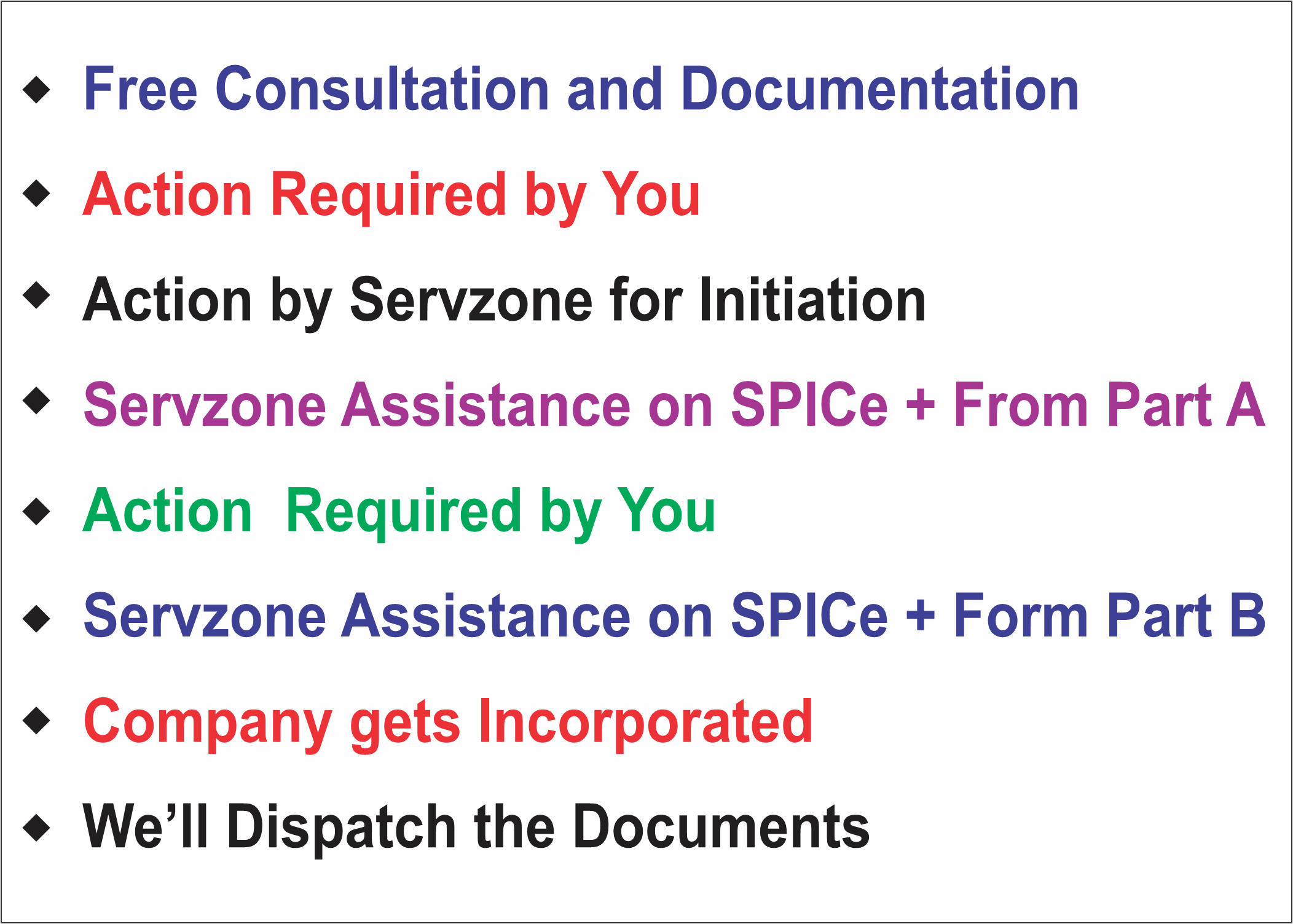

Company registration filing form

SPICE Plus serves many requirements such as name reservation, incorporation, DIN allocation, PAN, TAN, EPFO, ESIC, Profession Tax (Maharashtra) and bank account opening and can also get GSTIN from SPICE + form.

Part A:

Name Reservation (Applicable for new companies only)

Part B:

- Company Incorporation

- Application for DIN

- PAN Application

- TAN Application

- GSTIN Application

- EPFO Registration

- ESIC Registration

- Opening of Bank Account for the Company

- Profession Tax Registration (only for Maharashtra)

Business Entities Comparison Guide

OPC

- Only 1 member is required;

- The entity is considered a separate legal entity;

- Members' liability is limited to the extent of share capital;

- The registration of the unit is under the MCA and Companies Act, 2013;

- Only one person is allowed to transfer OPC;

- An OPC is responsible for paying income tax at the rate of 30% of remunerative cess and surcharge..

- Income tax returns are filed with the Registrar of Companies.

Proprietorship

- A maximum of 1 member is required;

- The entity is not treated as a separate legal entity;

- The obligation of members is unlimited;

- Registration of the institution is not mandatory;

- The transferable option is only as an individual;

- The profit and loss of the business should be stated in the sole owner's personal income tax return. Business itself is not taxed.

- Income tax returns are filed with the Registrar of Companies.

LLP

- A minimum of 2 members are required. There is no limit on the maximum number of members;

- Is the entity considered a separate legal entity?

- Members' liability is limited;

- The unit is registered under the MCA;

- The transferable option of LLP is 30% profit plus cess and surcharge applicable;

- LLP is liable to pay income tax for the benefit plus cess and surcharge applicable at the rate of 30%;

- Income tax returns are filed with the Registrar of Companies.

Private Company

- Requires a minimum of 2 and a maximum of 200 members;

- The entity is considered a separate legal entity;

- Members' liability is limited to the extent of share capital;

- The institution is registered under MCA.

- Private company LLP's transferable option 30% profit plus cess and surcharge applicable;

- A private company is responsible for paying income tax at the rate of 30% of the beneficial cess and surcharge..

- Income tax returns are filed with the Registrar of Companies.

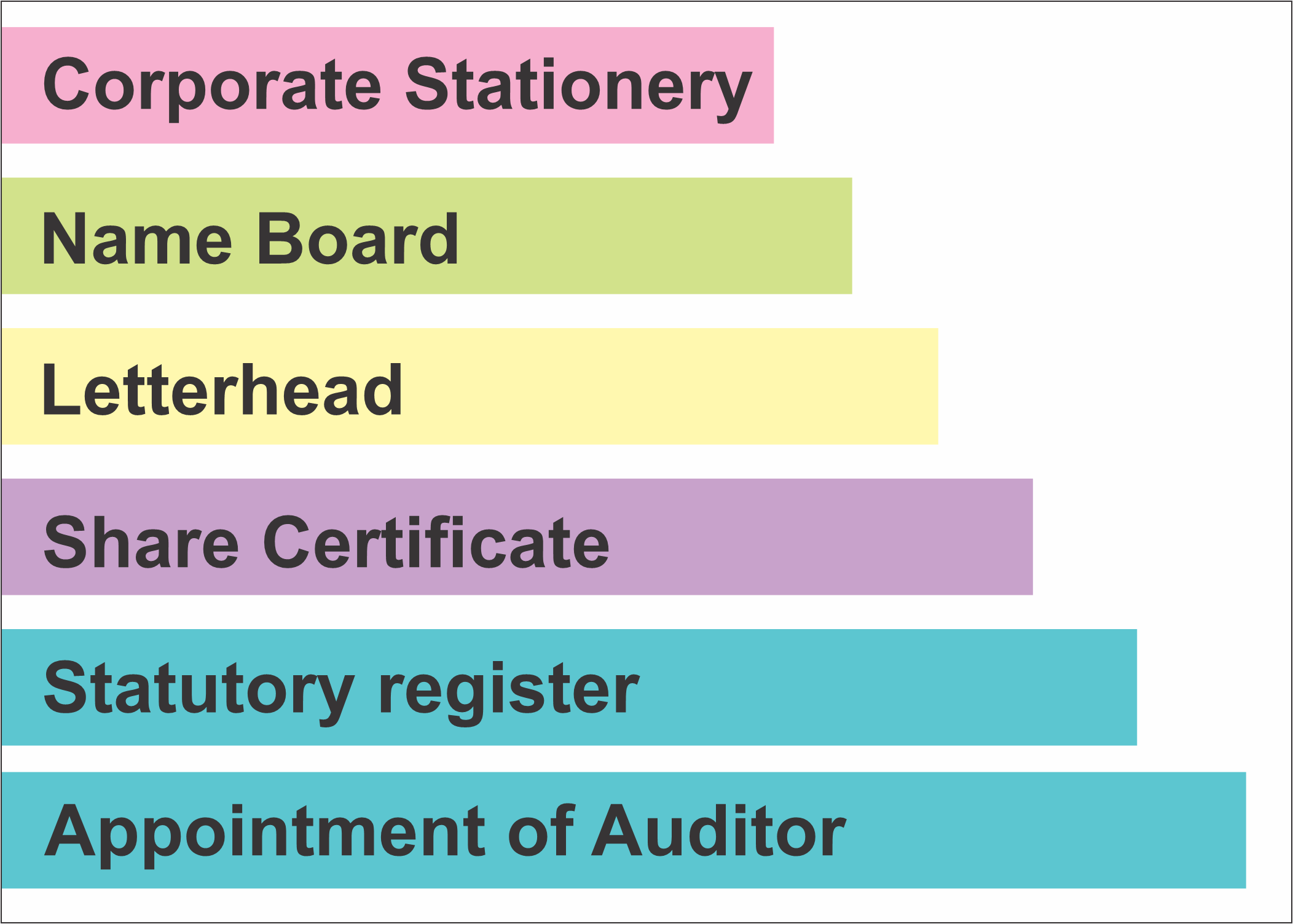

- Corporate stationery

The company should obtain corporate goods to use in compliance matters of the company.

- Name Board

Companies are required to find out the name of the company and the location of its registered office outside each office.

- Latterhead

Companies should publish the company name and registered office address on all letterheads, receipts, announcements and other official records of the company.

- Share Certificates

Companies have to give share certificates to all contributors within two months from the date of establishment.

- Statutory Register

All companies are required to maintain a statutory register for the company which includes members' register, list of directors, fees, debentures and other matters regarding shareholders and administration of the company..

- Appointment of Auditor

After the incorporation of the company, the board of directors is required to nominate the first auditor of the company, a chartered accountant, within 30 days of incorporation.

How can we help you?

Post Private Limited Company Incorporation Formalities

GST Registration

PVT. LTD. Company

Loan

Insurance